Shopping cart abandonment can be one of the most frustrating metrics for an ecommerce business owner. If your abandoned cart rates are increasing, you may want to take a closer look at your checkout process.

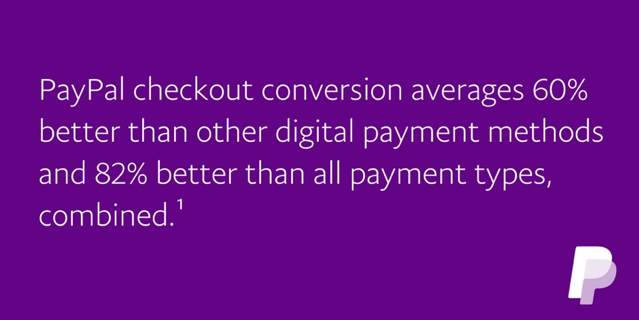

An optimized checkout should require as few clicks as possible; be streamlined for mobile, and offer secure payment options that let visitors pay the way they want. For example, adding a PayPal Checkout button to a product page lets customers with a PayPal account check out in just two clicks. And the average checkout conversion rate for PayPal customers hovers around 88.7%,1so just offering PayPal as a payment option can help you close more sales.

Turn browsers into buyers with Pay Later

PayPal Pay Later is now available on OpenCart. Help increase sales by offering Pay Later options to your customers. Pay Later options allow customers to pay over time while you get paid up front — at no additional cost to your business. And since 81% of consumers decide which payment method to use before they get to checkout2, adding dynamic Pay Later messaging can help you increase conversions3, boost average order values (AOV)4, and encourage customers to buy more5 — and more often.6

Pay in 3 (UK, IT, ES) 3 interest-free payments over 2 months.*

*Down payment due at purchase and 2 monthly payments.

PayPal Pay Later is available in these countries:

Let them Venmo.

Venmo is already part of the new PayPal Checkout — at no additional cost. Gain appeal to Venmo customers who are active spenders7 with more spending power.8 And help bring more visibility to your business with a payment method customers can easily share.

A new Venmo behavior study shows that 47% of customers are interested in paying with Venmo if offered. And 89% of consumers prefer to pay with Venmo because they trust the brand and it's ease of use.

You want to choose the checkout payment options that are convenient for your customers and improve your conversion rates?

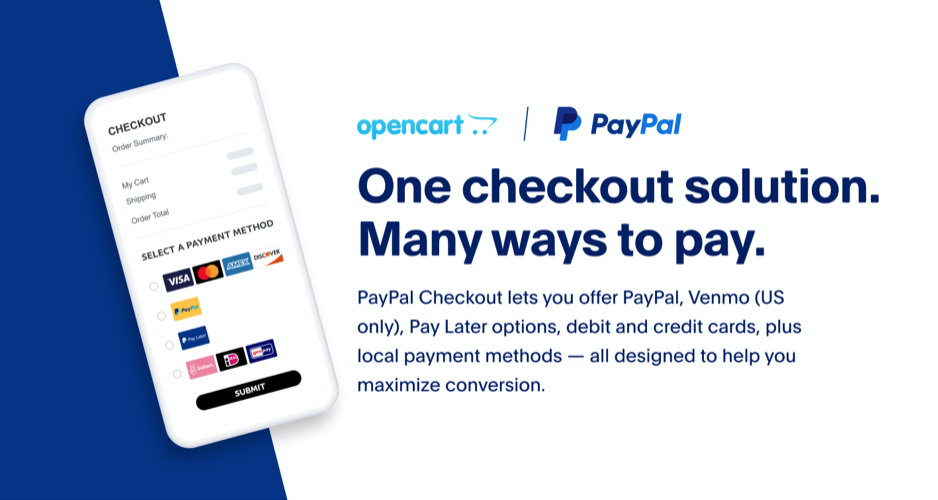

With a single integration, PayPal Checkout lets your customers pay with PayPal, Venmo (US), PayPal Pay Later9, debit and credit cards, Lastschrift (GER), and over 10 different country-specific, local payment methods that help drive conversion and encourage cross-border trade – all without leaving your site. And the technology behind PayPal Checkout automatically shows them the most relevant payment options.

Here’s how updating to PayPal Checkout can help your business

Encourage checkout anytime.

Offer customers the flexibility to check out quickly at any time by showing PayPal on your product, shopping cart and checkout pages.

Few clicks, less friction.

Streamlined checkout helps reduce cart abandonment, drive conversion rates, and encourage repeat business. With PayPal, customers can use their saved billing and shipping info to checkout fast — on any device.

Help boost conversion rates and increase cart sizes by 39% with Pay Later options.10

With PayPal Pay Later, customers can pay over time while you get paid in full, up front — at no additional cost. 63% of buy now, pay later (BNPL) users are more likely to complete a purchase if a buy now, pay later option is available.11

Comes with Venmo and NextGen appeal. (US)

Venmo is the go-to payment option for Millennial and Gen Z shoppers12 and has active spenders with more spending power.13

Competitive pricing

When integrating the new PayPal Checkout you will get separate and competitive pricing for PayPal payments and card payments, which can help you save money.

PayPal Fraud detection.

You could save time and money by letting PayPal help you handle the risk of fraudulent transactions with our fraud, Chargeback, and Seller Protection14 capabilities (on eligible transactions, terms apply). Our AI technology works hard to monitor all your transactions – so you can focus on what matters most.

To update to PayPal Checkout, follow the steps provided here: OpenCart - PayPal Checkout Integration

Disclaimer:

1 comScore online panel, Q4 2017. Analyzed shopping behavior of 1 million US consumers on 20 large merchant sites. Checkout conversion is measured from the point where consumer selects a payment type to completion of purchase.

2 TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among Millennial & Gen Z BNPL users (ages 18-40), US (n=222), UK (n=269), DE (n=275), AU (n=344), FR (n=150).

3 62% of BNPL users say that seeing a buy now, pay later message while shopping encouraged them to complete a purchase. TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among BNPL users, US (n=282), UK (n=303), DE (n=342), AU (n=447), FR (n=255)).

4 PayPal's Buy Now, Pay Later is boosting merchant's conversion rates and increasing cart sizes by 39%. PayPal Q2 Earnings-2021.

5 80% of BNPL users agree that seeing a BNPL message while browsing gives them the ability to spend more. An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39. (Among BNPL Users, n= 357)

6 74% of BNPL users are more likely to shop at a merchant again if they offer a buy now, pay later option. TRC online survey commissioned by PayPal in April 2021 involving 1000 US consumers ages 18+ (among BNPL users, n=282).

7 Focus Vision, Commissioned by PayPal. October 2020. The Venmo Behavior Study explores valuable insights for merchants to consider to reach a broader audience including 2,217 Venmo customers' financial habits, purchasing behaviors and perceptions of Venmo as a payments tool.

8 50% of Venmo users are more likely to have a high household income than online payment users overall. (Page 8). Source: Statista Global Consumer Survey as on July 2020. The target population are internet users in U.S. between 18 and 64 years of age.

9 Pay Later product availability subject to local requirements. Merchant and consumer eligibility varies depending on status and integration. Credit checks, fees, and other requirements apply and vary depending on product jurisdiction. See product-specific terms for details.

11 TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among BNPL users, US (n=282), UK (n=303), DE (n=342), AU (n=447), FR (n=255)).

12 Venmo is a popular payment option for Millennial and Gen Z shoppers. Source: Statista Global Consumer Survey of 682 Venmo users, July 2020. The target population is internet users in the U.S. between 18 and 64 years of age.

13 50% of Venmo users are more likely to have a high household income than online payment users overall. Source: Statista Global Consumer Survey July 2020. The target population are internet users in U.S. between 18 and 64 years of age.

14 Available on eligible purchases. Terms apply see here.

Login and write down your comment.

Login my OpenCart Account